Top Immigrant Billionaire Stories 2025

Top Immigrant Billionaire Stories 2025

immigrant billionaire stories 2025.The latest Forbes list of the world’s richest individuals includes a record-breaking 125 immigrants living in the United States.

Discover inspiring immigrant billionaire stories 2025

Investment Tips for Arabs Abroad | 2025 Smart Guide

Bitcoin for Arab Investors

Top Business Tips for Expats in 2025

But their opinions on America’s current immigration policies, particularly under President Trump’s administration

immigrant entrepreneurs in America.reveal a wide range of perspectives. Many of these self-made billionaires,

who built fortunes after arriving in the U.S., believe that if today’

s immigration restrictions had been in place when they immigrated, they may never have had the opportunity to succeed.immigrant entrepreneurs

billionaire immigrants in the US

immigration and business success.Real estate mogul Jorge Pérez didn’t hold back when reflecting on how today

U.S. billionaires born abroad.s immigration climate could have affected his own journey.billionaire immigrants

billionaire success stories in the U.S“If the current administration’s policies had been in place back then,

my family might never have made it to the U.S.,” he said, referencing former friend and business associate Donald Trump.

how immigrants became wealthy.Born in Argentina in 1949 to Cuban parents, Pérez moved to Miami in 1968 and became a U.S.

citizen in 1976. Over the years, he built a $2.6 billion fortune and partnered with Trump on several real estate ventures

In fact, Trump once praised him in the introduction to Pérez’s 2008 book to Pérez’s 2008 book Powerhouse Principles,

foreign-born billionaires in 2025.calling him “the one person who could teach me something about real estate.”

immigrant founders and CEOs.However, their relationship shifted in 2017 when Pérez publicly rejected Trump’

the American Dream for immigrants.s request to assist with building a wall along the U.S.-Mexico border.

At the time, Pérez labeled the project “an insult to Hispanics and perhaps to all immigrants in America.

” Today, with Trump pushing forward aggressive immigration enforcement and plans for mass deportations, Pérez continues to speak out.

immigrant entrepreneurs stories

While Pérez acknowledges the need for rules around immigration,

he draws a firm line when it comes to blanket crackdowns.

“I believe undocumented immigrants who break the law should face consequences,

including deportation,” he admits. “But the actions of this administration are, in my view, unacceptable.

Many undocumented individuals have worked hard,

stayed out of trouble, and positively contributed to our communities—they deserve a legitimate path to citizenship.”

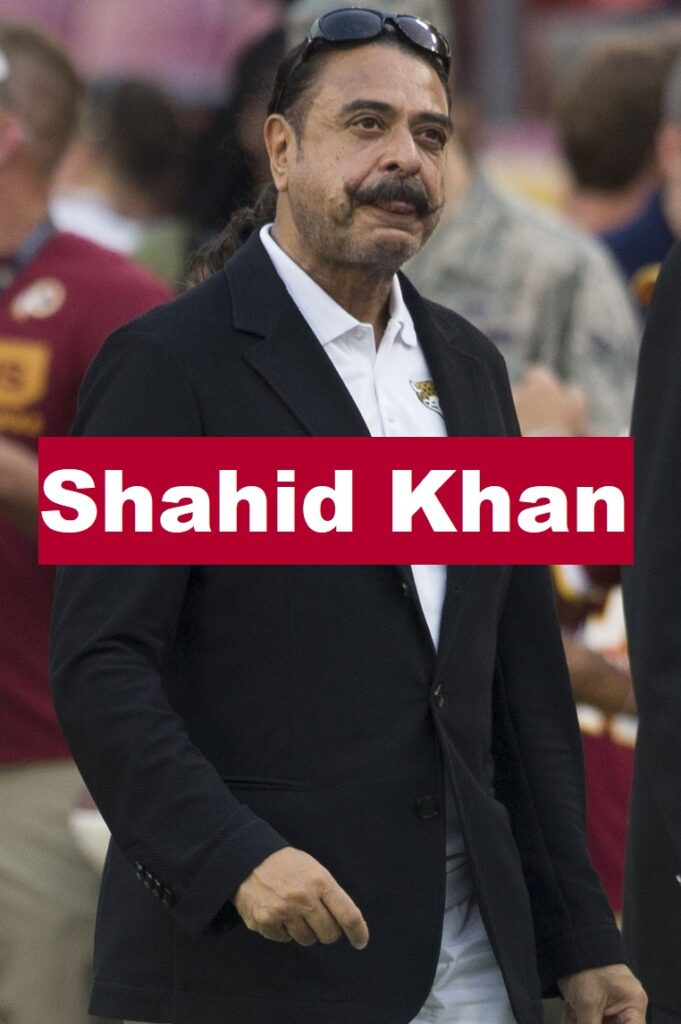

self-made immigrant millionaires: Shahid Khan on Growth, Grit, and America

Shahid Khan, owner of the Jacksonville Jaguars and founder of auto parts giant Flex-N-Gate,

.immigrant billionaire stories 2025.came to the U.S. from Pakistan at 16.

One of his first jobs was washing dishes for $1.20 an hour

—more than what the vast majority of people in his home country earned at the time.

Although Khan doesn’t speak as directly as Pérez, he’

s also critical of how many innocent people are being affected by Trump’s immigration policies.

“We need immigrants to keep this country moving forward,” he says,

noting that many of his company’s U.S. factory workers are refugees and immigrants from countries like Tunisia, Bangladesh, and Morocco.

how immigrants became billionaires

Khan and Pérez are just two of the 116 self-made immigrant billionaires.

currently living in the United States. Another nine inherited their wealth.

Trump even called Pérez ‘a real estate genius’ in his 2008 book to understand how they view today’

s immigration landscape, whether they still believe the U.S. is the land of opportunity,

and if they would choose America again if they had to start over.

A dozen of them agreed to share their stories and reflections.

Forbes reached out to many of these entrepreneurs to understand how they view today’s immigration landscape,

whether they still believe the U.S. is the land of opportunity, and if they would choose.

America again if they had to start over. A dozen of them agreed to share their stories and reflections.

immigrant success stories: Shahid Khan on the Power of Immigration

While nearly all of these billionaires entered the U.S. legally, there have been lingering questions in a few cases. For example, there’s speculation around whether Elon Musk, originally from South Africa, began working at a tech company before securing the proper work visa. Recently, Trump hinted at possible deportation for Musk, as tensions between the two former allies continue to rise over Trump’s ambitious tax-and-spending proposa

Immigrant Billionaire Stories 2025: How Trump’s Travel Ban Impacts Talent From Iran and Cuba

Under Trump’s renewed leadership, legal immigration has also become more complicated. Early this year, the administration reinstated a controversial travel ban originally introduced during Trump’s first term. The new executive order restricts or outright blocks citizens from 19 countries from entering the U.S.—including Cuba, the homeland of Pérez’s family, and Iran.

That’s notable because Iran has produced several of America’s wealthiest immigrants. Among them are Adam Foroughi of AppLovin, Behdad Eghbali of Clearlake Capital, and Joe Kiani, founder and former CEO of medical device company Masimo Corporation.

Immigrant Billionaire Stories 2025: Why Today’s U.S. Might Not Welcome Tomorrow’s Innovators

Joe Kiani, who moved to the U.S. from Iran as a child in the 1970s, says he likely wouldn’t have been able to come under today’s restrictions. His family came so his father could pursue a degree in engineering at the University of Alabama in Huntsville. “Back then, America welcomed us with open arms—we felt like we belonged,” Kiani recalls. “If my father were trying to get that same education today, he might choose a different country—one that still embraces foreign students the way the U.S. did in 1973.”

Maky Zanganeh, an Iranian-born biotech executive and co-CEO of Summit Therapeutics, didn’t comment directly on Trump’s policies. However, she disagreed with Kiani’s perspective. “Even today, I would still move to the United States,” she said. “No other country matches the American spirit—its belief in innovation, opportunity, and the willingness to support big ideas.”

Why Some Immigrant Entrepreneurs Still Believe in the American Dream

Why Some Immigrant Billionaires Still Back Trump’s Immigration Policies❗

Not all immigrant billionaires are opposed to Trump’s stance. Some remain strong supporters—like Israeli-born physician and philanthropist Miriam Adelson, who contributed nearly $6 million to pro-Trump political groups in 2024.

Another supporter is Mark Jones, a Canadian-born entrepreneur who co-founded Goosehead Insurance in Texas. “Opening the borders the way the Biden administration did was a serious mistake,” he said. “I fully support immigration—but there’s a difference between people who come here to build a future and those who come only to rely on government aid.”

Jones’s wife and business partner, Robyn Jones, is also a Canadian-born billionaire and shares his view.

Balancing Immigration Enforcement with Economic Contribution and Fairness

Billionaire businessman John Catsimatidis, who immigrated from Greece as an infant, had a direct conversation with Trump before the last election. “I told him, ‘Why not start by removing the real criminals—drug dealers, violent offenders, those causing harm?’” he said. “If someone’s working hard, seven days a week, maybe ICE should just let them be.”

Catsimatidis grew up in Harlem, where his father worked tirelessly in restaurants as a busboy, waiter, and chef. When asked if Trump’s mass deportation plans risk removing hardworking people alongside lawbreakers, Catsimatidis admitted that errors happen—but he doesn’t believe they’re intentional. “I’m pro-immigrant. I am an immigrant. But the country wants people who work hard like our fathers and grandfathers—not those who expect a free ride,” he added. “I don’t think we should be paying $300 a night to house migrants in hotels while U.S. veterans sleep on the streets. That’s not justice.”

The Case for Skilled Immigration and Shared Values in America❗

Oren Zeev, an Israeli-born venture capitalist, supports Trump’s tough approach to illegal immigration. But he also believes legal immigration should be streamlined for those who bring value to the U.S. “Cracking down on illegal immigration doesn’t mean you’re anti-immigrant,” he said. “In fact, we should be doing more to welcome highly skilled individuals who can contribute to our economy.”

He also emphasized that new arrivals should respect the values of the country they choose to live in. “Becoming American is a privilege. If someone harbors radical beliefs or wants to harm this country, they shouldn’t come at all.”

The Resilience of the American Dream Among Immigrant Billionaires❗

Despite their differing opinions on policy, nearly all of the immigrant billionaires interviewed agreed on one thing: America still holds unique promise.

“The beauty of this country is that even in tough times, it eventually finds its way,” said Shahid Khan. “America remains the land of opportunity—and no single person, not even a president, can erase the American dream. It’s stronger than that.”

📌 Editorial Note

This article is based on publicly available interviews, profiles, and statements from high-profile immigrant entrepreneurs featured in publications such as Forbes and other trusted media outlets. Quotes have been paraphrased or summarized for clarity and flow.

Want more stories like this?

Explore our Money & Business section for tips, trends, and inspiration from global entrepreneurs. 👉 [Visit Now]

📌 Frequently Asked Questions (FAQs)

Q: How did Jorge Pérez become a billionaire?

Jorge Pérez built his fortune through real estate development in Miami. Born in Argentina to Cuban parents, he moved to the U.S. in the late 1960s and later co-founded The Related Group. Over decades, he became one of the most influential real estate developers in the U.S., even partnering with Donald Trump on luxury projects.

Q: Which immigrant billionaires support Trump’s immigration policies?

While many immigrant billionaires have voiced criticism, some remain strong supporters of Trump’s approach to immigration. Notably, Israeli-American philanthropist Miriam Adelson and Canadian-born Mark Jones, co-founder of Goosehead Insurance, have both expressed support for stricter border control measures and selective immigration policies.

t66lys