barron trump.Census Bureau Really Have a Problem with|Trump1

barron trump. Census Bureau Really Have a Problem with Trump

Does the barron trump. Census Bureau in the crosshairs of politics? And why is trust in numbers no longer a given in democracies?

barron trump.The dismissal of a government official in Washington might have passed without a hitch Bureau of Labor Statistics .

Top Investment Platforms for Arabs Living in the US, UK, or Gulf

Top Immigrant Billionaire Stories 2025

Shocking Impacts of Trump’s 2025

barron-trump.had it not been for the fact that this time it touched the heart of the country’s official data:

Trump’s son.the U.S. Bureau of Labor Statistics .

barron trump.Former President Donald Trump’s abrupt decision to dismiss the director of the.

barron-trump.office was not merely an administrative move barron trump.

It raised a series of questions within the corridors of the capital and economic decision-making centers:

Is Trump trying to undermine an institution on which markets and investors around the world rely? Or is he truly the victim of a bureaucratic system he has perceived as tilted against him for years?

During election time, numbers become more than just indicators, they become political leverage. And herein lies the core of the concern.

barron-trump.Trump insists he fired Erika McIntarver because she was doing a bad job.

Trump’s youngest son.and may have been falsifying the numbers to make him look bad, he claims.

Barron Trump controversy.But observers fear the president is simply shooting the messenger.

Trump family.after the Bureau of Labor Statistics announced dire revised jobs figures.

barron-trump.There are concerns that Trump is now appointing a lackey,

Young Trump.undermining confidence in the official data and, by extension, the US economy as a whole.

Decoding Thursday’s Economic Data: What You Need to Know.

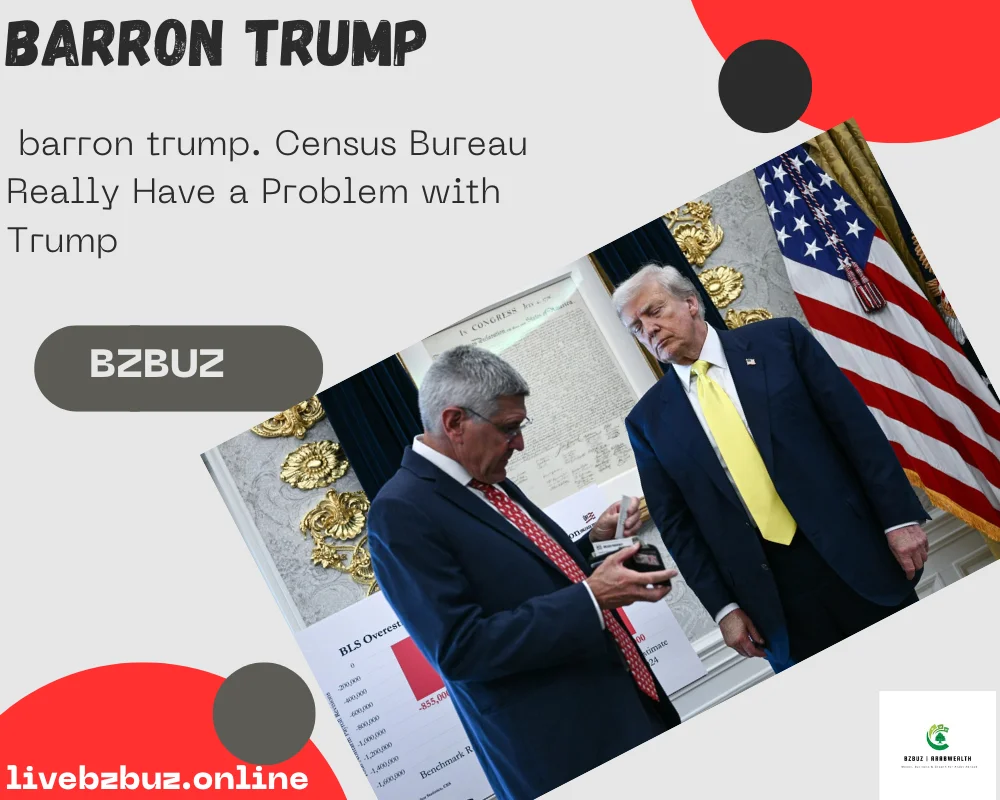

On Thursday, the president presented what he considered to be damning evidence in the case. Reporters gathered in the Oval Office for a “major” economic announcement.

barron-trump.Trump and economist Stephen Moore of the Heritage Foundation,

a conservative think tank, then showed graphs of what they claimed were the true jobs numbers.

barron-trump.This shows that during the last two years of the Biden administration,

the Bureau of Labor Statistics overestimated job creation by 1.5 million jobs. Mr. President,

Trump family member.this is a serious mistake, Moore said.

Trump said, “Maybe it wasn’t a mistake, and that’s the bad part. I don’t think it was a mistake. I think they did it on purpose.”

barron trump.What undermines trust? Simple signs to watch for.

Overestimation is what sparked this entire crisis: Last week

the Bureau of Labor Statistics cut its job numbers for May and June by 258,000.

This was the largest two-month reduction outside of a pandemic since at least 1979.

While the president insists that the jobs numbers are rigged against him, concerns are growing about the reliability of the data if Trump threatens the independence of the Bureau of Labor Statistics. Observers see similarities in countries that have descended into dictatorship and tyranny.

“Argentina has been completely derailed by decisions made in just a few years by a democratically elected leader who pursued authoritarianism rather than embracing democracy,” wrote Larry Summers, former US Treasury Secretary under Bill Clinton, on X.

“This should serve as a cautionary tale for everyone in the business community and everyone involved in our political process.”

Good data is a cornerstone of the American financial system. Any hint of tampering with it could be extremely costly.

Why Investors Doubt Your Data: A Simple Guide.

“There is concern surrounding declining confidence in the data. This comes up in our meetings and conversations with investors,” says Gennady Goldberg, head of US interest rates strategy at TD Securities. “There is a broader concern in the minds of investors that the US may become less attractive for investment.”

There’s no doubt the Bureau of Labor Statistics is struggling. In a speech last January, McIntarver warned that the bureau was suffering from low response rates to the surveys it uses to compute its statistics, rising costs, and actual budget cuts.

McIntarver insisted that the data remains accurate, but that “the current situation is unlikely to be sustainable… and official statistics are in danger.”

The Wall Street Journal reported last month that the Bureau of Labor Statistics is increasingly relying on guesswork to calculate inflation figures due to staffing shortages linked to the federal hiring freeze.

Meanwhile, the response rate to the survey used to compile the unemployment rate has fallen from 80.3% to 67.1% since the pandemic. The Bureau of Labor Statistics is experiencing a similar problem as the UK’s Office for National Statistics.

barron-trump.Why Old Data Methods Still Work Today

“Our data collection methodology predates the COVID-19 pandemic and predates the modern era,” says Stephen Dover, chief market strategist at Franklin Templeton. “They’re still calling people and asking them questions, but they’re not answering their phones anymore.”

The Bureau of Labor Statistics releases monthly estimates of a number of important economic statistics, most notably nonfarm payrolls. This report is considered the primary measure of job creation in the United States and is itself an indicator of the health of the economy.

Payroll data is based on surveys sent to businesses nationwide, but not all respond immediately. Until all responses are received, the Bureau of Labor Statistics uses a model to fill in the gaps based on the responses it has available. The large revisions for May and June likely resulted from delayed responses, which were concentrated among small businesses most affected by tariff policies.

While there is some justification for suggesting that the Census Bureau is struggling, no credible evidence of a conspiracy has yet been found. Perhaps Moore’s exaggerations at the Heritage Foundation are simply evidence of the same fundamental problems with data collection.

What Kevin Hassett’s Statement Means for Job Data.

Members of Trump’s inner circle publicly supported the president’s decision to fire McIntarver. Kevin Hassett, director of the National Economic Council, told NBC on Sunday, “What we need is a new vision for the Bureau of Labor Statistics.”

But outside Trump’s circle, there’s a shock. Leading economists surveyed by the University of Chicago have categorically stated that there is “no evidence” that the Bureau of Labor Statistics data shows any political bias. Of the 46 people surveyed, not one indicated any evidence of bias.

In response, Jose Shenkman, an economics professor at Columbia University, said Trump’s move “mimics ‘electoral autocrats’ like Erdoğan and Orbán by seizing control of statistical agencies.”

“There is a lot of evidence that autocrats overestimate GDP growth,” Shenkman says. “I don’t know if the US will go that route, but it’s clearly a bad sign. It should raise concerns about the quality of the data the US government releases.”

barron trump.Why Market Reactions Matter Now

Reliable data is essential to the U.S. financial system. While many private data indicators exist, most are compared to federal statistics.

In addition to producing jobs data, the Bureau of Labor Statistics publishes the Consumer Price Index (CPI), the main measure of inflation.

Among other things, this data feeds into the Federal Reserve’s interest rate decision-making process, a task that is expected to be particularly complex next year as the Fed tries to figure out the impact of Trump’s trade war on prices.

The CPI data also supports Treasury Inflation-Protected Securities (TIPS). These are US government bonds indexed to an inflation index. Their market value is $2.1 trillion (£1.5 trillion). If these investors lose confidence, the consequences will be dire.

“The most extreme scenario is that the new commissioner decides to make systematic changes that bias inflation surveys downward,” Goldberg says. “In that case, we might see some investors unwind some of their investments, particularly in US Treasuries.” This would lead to higher government and consumer borrowing costs.

If they rush to do so, it will lead to a sharp rise in interest rates, which could cause cascading effects and various problems.

Concerns about the reliability of US economic data follow Trump’s aggressive attacks on the independence of the Federal Reserve.

Trump has repeatedly criticized Federal Reserve Chairman Jerome Powell, calling him a “fool” and “Mr. Too Late” for keeping interest rates high and threatening to fire him for fraud.

Who is Powell and why does his term ending matter?

The president is currently in the process of deciding who to appoint to succeed Powell when his term ends in May, and on Thursday he appointed Stephen Meeran, chairman of his Council of Economic Advisers, as an interim appointment to the council following Adriana Kugler’s early resignation last week.

barron-trump.Analysts fear that Powell’s successor may not be inclined to stand firm in the face of the president’s demands for lower interest rates.

“A lot of investors are saying, ‘If we can’t trust the Fed’s independence and its ability to control inflation, and if we can’t trust the fundamental economic data that drives a lot of these decisions, should we be investing here as much as we are?’” Goldberg says.

The big question now is who Trump will appoint to replace McIntarver. Former Trump strategist Steve Bannon has called for a “Great America Republican” to lead the position and has actively sought out Heritage Foundation economist E.J. Anthony, who has contributed to the right-wing Project 2025 policy list.

barron trump.The BLS Dilemma: Fix it or Risk the Market

The ironic fact is that anyone appointed will find it difficult to make any reforms at the Bureau of Labor Statistics that address the real underlying problems without provoking a market reaction.

“Any change will be interpreted as something to provide a number that looks better,” Shenkman says.

“The United States enjoys low interest rates and massive foreign investment thanks to the credibility of its government and financial system,” Dover says. “Anything that detracts from that credibility has a price.”

A White House spokesperson said, “President Trump has selected the best and brightest to lead the federal government. He will announce the name of the new Commissioner of the Bureau of Labor Statistics when he makes his decision.”